See why 250,000+ families, 75+ government agencies,

250+ banks and trust companies, and 300+ nonprofits have chosen True Link**

Excellent

4.5 Stars on TrustPilot

Inclusive Community

Development AwardsNDI 2021 Winner

Torch Award

for EthicsBBB 2021 Winner

Champions

For ChangeCNN 2021 Honoree

The True Link Visa® Prepaid Card

and Spending MonitorLearn more

Investment Management* and

Trust AdministrationLearn more

For Professionals

Simplify client spending and investment management*

Visa card for fund disbursement with oversight

Conveniently transfer funds for all your clients and track spending with real-time alerts and automated reporting

Investing for pooled and special needs trusts

Our expertise is in investment management* for special needs trusts and other fiduciary accounts

Tools for streamlined trust administration

Our powerful, easy-to-use trust administration software empowers trustees by enabling integrated payments, recordkeeping, reporting, and more

and platform can help support you and those you care for.

For Families

Help protect the finances and independence of your loved ones

A prepaid Visa card to help make spending easier

Easy to set up and fund from a bank account and can be used everywhere Visa debit cards are accepted

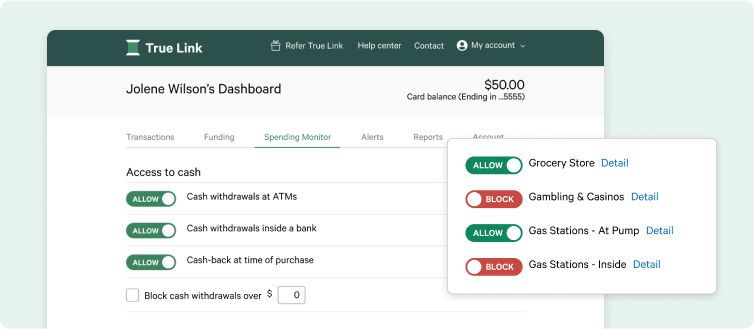

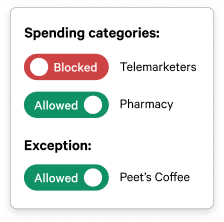

Spending settings that help limit certain purchases

Customize where and when your loved one can make purchases to help protect spending and prevent fraud

Alerts and purchase history to help stay in the loop

Use real-time alerts to stay informed of recent purchases and view reports for an overview of spending history